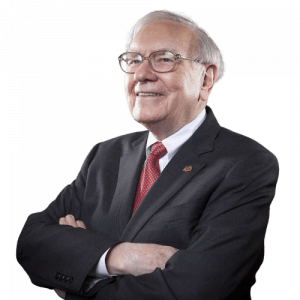

Warren Buffett

Warren Buffett sees på som tidenes beste investor. Gjennom Berkshire Hathaway har han oppnådd en gjennomsnittlig årlig avkastning på over 20% i mer enn fem tiår. Hans investeringsstrategi vektlegger langsiktig verdiinvestering og fokus på selskaper med sterke konkurransefortrinn og jevn inntektsvekst.

Portefølje

It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.

Tekster

Artikler og intervjuer

- Warren Buffett Interview (1962)

- How Omaha Beats Wall Street (1969)

- The Money Men (1974)

- How Inflation Swindles the Equity Investor (1977)

- Warren Buffett: The Investor's Investor (1979)

- The Superinvestors of Graham-and-Doddsville (1984)

- Discussing Timeless Investment Principles (1985)

- Will the Real Warren Buffett Please Stand Up? (1990)

- Hvordan alt startet for Warren Buffett (1990)

- Warren Buffett’s Idea of Heaven: “I Don’t Have To Work With People I Don’t Like” (1993)

- Buffett On Bridge (1997)

- Mr. Buffett On The Stock Market (1999)

- A Word From A Dollar Bear (2005)

- Warren Buffett: Why Stocks beat gold and bonds (2012)

- Warren Buffett on His Early Career in Finance (2016)

Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.