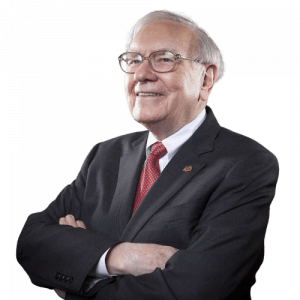

28 investeringskriterier fra Warren Buffett

Han er ansett som tidenes beste investorer. Her er en liste med 28 investeringskriterier som er inspirert av han.

1. Is the business understandable?

2. Do you know how the money is made?

3. Does the business have a consistent operating history?

4. Does the company have favourable long term prospects?

5. Is there a big moat around the business (a high threshold

of entry) ?

6. Is it a business that even a dummy could make money in?

7. Can current operations be maintained without too much

needing to be spent?

8. Is the company free to adjust prices to inflation?

9. Have you read the annual reports of the main competitors?

10. Has the management demonstrated a high degree of

integrity (honesty)?

11. Has the management demonstrated a high degree of

intelligence?

12. Has the management demonstrated a high degree of

energy?

13. Is management rational?

14. Is management candid with shareholders (evidence in the

past of open disclosure to the shareholders when there

have been problems)?

15. Has management resisted the temptation to grow quickly

by merger?

16. Has management the strength not to follow the

institutional imperatives ( avoid following current business

and sector fads)?

17. Has the business been free of a major merger in the last 3

years ( many merger failures come out of the woodwork

within this period)?

18. Are stock options tied to SMT performance rather

organisation’s performance (if your team wins you do not

pay a .35 hitter the same as a .15 hitter.)?

19. Are stock options treated as an expense?

20. Is the return on equity adequate?

21. Is the company conservatively financed?

22. Has the company had a track record of earnings growth in

most years above the stock market average?

23. Are the profit margins attractive (better than industry)?

24. Has the company created at least one dollar of market

value for every dollar of earnings retained?

25. Is the value of discounted earnings greater than the

current market value?

26. Have you discounted at a rate equal or greater than the 10

year bond rate (risk free rate)?

27. Have cash flows been based on net income, plus depreciation, depletion, and amortization, less capital expenditure and additional working capital requirements?

28. Has the company been temporarily punished for a specific

risk that is not a long term risk (the market tends to over

punish the share price)?