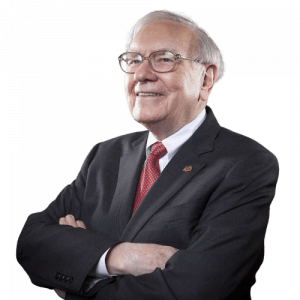

5 faktorer Warren Buffett vurderer

I 1993 la Warren Buffett frem 5 faktorer enhver investor må vurdere i en investering.

In our opinion, the real risk that an investor must assess is whether his aggregate after-tax receipts from an investment (including those he receives on sale) will, over his prospective holding period, give him at least as much purchasing power as he had to begin with, plus a modest rate of interest on that initial stake. Though this risk cannot be calculated with engineering precision, it can in some cases be judged with a degree of accuracy that is useful. The primary factors bearing upon this evaluation are:”

1) The certainty with which the long-term economic characteristics of the business can be evaluated;

2) The certainty with which management can be evaluated, both as to its ability to realize the full potential of the business and to wisely employ its cash flows;

3) The certainty with which management can be counted on to channel the rewards from the business to the shareholders rather than to itself;

4) The purchase price of the business;

5) The levels of taxation and inflation that will be experienced and that will determine the degree by which an investor’s purchasing-power return is reduced from his gross return.

These factors will probably strike many analysts as unbearably fuzzy, since they cannot be extracted from a data base of any kind. But the difficulty of precisely quantifying these matters does not negate their importance nor is it insuperable. Just as Justice Stewart found it impossible to formulate a test for obscenity but nevertheless asserted, “I know it when I see it,” so also can investors – in an inexact but useful way – “see” the risks inherent in certain investments without reference to complex equations or price histories.